Park 64 Capital Blog

Thanks for stopping by and checking out our blog. We post interesting things about finance that we think are of use to the general public, but you should never interpret anything on our website to be financial advice.

2026 Retirement Plan Contribution Limits

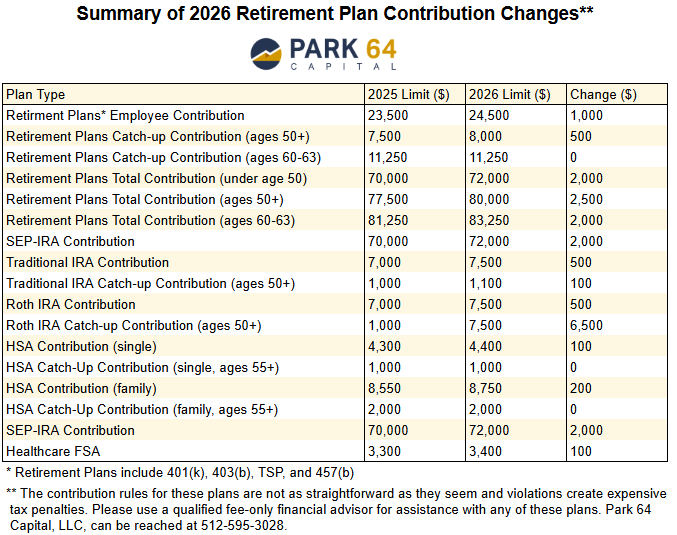

The IRS has made notable increases to the contribution limits for 401(k)s, IRA, catch-up contributions, and HSAs in 2026.

The IRS has made some notable changes to retirement plans in 2026, including an increase to the 401(k), 401(k) catch-up, IRA, and HSA contribution amounts. A summary table is below.

In many cases, application of these rules can be tricky, especially if you’re married, in a domestic partnership, have access to multiple plans, are self-employed, or lose plan access mid-year; the nuances of these cases are not covered here.

2026 401(k), 403(b), and TSP Employee Contribution Limit

The employee contribution limit for 401(k), 403(b), and TSP plans has increased from $23,500 in 2025 to $24,500 in 2026.

The catch-up contribution for those ages 50 and older has increased to $8,000 in 2026, which means employees ages 50 and older can contribute up to $32,500 in 2026.

The super catch-up contribution provision for those ages 60–63 remains at $11,250 in 2026, which means those ages 60–63 can contribute up to $35,750 in 2026.

2026 401(k), 403(b), and 401(a) Total Contribution Limit

The combined employee and employer contribution limit for 401(k), 403(b), and TSP plans has increased from $70,000 in 2025 to $72,000 in 2026.

For those ages 50 and older, including the catch-up contribution, the maximum is $80,000 in 2026.

For those ages 60–63, using the higher catch-up provision, the maximum is $83,250 in 2026.

2026 457(b) Total Contribution Limit

The employee contribution limit for 457(b) plans has increased from $23,500 in 2025 to $24,500 in 2026.

Remember, those with access to both a 401(k) and a 457(b) plan can max out both plans in the same year.

The 457(b) catch-up contribution for those ages 50 and older is $8,000 in 2026; check with your plan administrator to see if the “last-3-year catch-up” provision applies.

2026 Traditional IRA and Roth IRA Contribution Limit

The contribution limit for Traditional IRAs and Roth IRAs has increased from $7,000 in 2025 to $7,500 in 2026.

The catch-up provision for those ages 50 and older is now $1,100 in 2026.

2026 Traditional IRA Income Phaseout Limits

For those who are unmarried without a retirement plan at work, Traditional IRA contributions are fully deductible in 2025.

For those with a retirement plan at work, the tax deductibility of Traditional IRA contributions has the following income phaseout ranges:

Single (2025): $79,000-$89,000

Single (2026): $81,000–$91,000

Married Filing Jointly (2025): $126,000 - $146,000

Married Filing Jointly (2026): $129,000 - $149,000

If you are married but only your spouse is covered by a retirement plan, the following phaseout range applies to you:

2025: 236,000-$246,000

2026: 242,000-$252,000

2026 Roth IRA Income Phaseout Limits

The Roth IRA contribution eligibility ranges have also increased:

Single and Head of Household (2025): $150,000 - $165,000

Single and Head of Household (2026): $153,000–$168,000

Married Filing Jointly (2025): about $236,000–$246,000

Married Filing Jointly (2026): about $242,000–$252,000

2026 Health Savings Account (HSA) Contribution Limits

For 2026, the HSA contribution limits are:

Self-only coverage: $4,400, up from $4,300 in 2025

Family coverage: $8,750, up from $8,550 in 2025

The HSA catch-up contribution for those ages 55 and older remains $1,000. Remember that for families, each partner may put $1,000 of catch-up contribution into their own individual HSA, but not into the same HSA, for a total of $2,000.

2026 Flexible Spending Account (FSA) Contribution Limits

The healthcare FSA contribution limit for 2026 has increased to $3,400, up from $3,300 in 2025.

Dependent care FSAs have separate limits and are not the same as healthcare FSAs.

2026 SEP IRA Contribution Limits

The SEP IRA contribution limit has increased from $70,000 in 2025 to $72,000 in 2026. Remember, SEP IRA contributions can only be made by the employer.

SOURCE: https://www.irs.gov/newsroom/401k-limit-increases-to-24500-for-2026-ira-limit-increases-to-7500

Retirees Need Mostly Stocks - Here’s Why

Should retirees be primarily in bonds? With stocks returning significantly more than bonds, I don’t think this is true.

Most households are advised that their portfolio should become increasingly bond focused as they age. This belief, which has been passed down from generation to generation, is an attempt to create a pragmatic approach to ensuring you never run out of money. Portfolios like the 60/40 are a classic example — a typical advisor tells a retiree to put 60% in stocks and 40% in bonds. Another common example is the target date fund in 401k plans, which increases bond allocation as the target date gets nearer.

I am of the firm belief that these types of strategies are actively harmful by limiting total wealth creation and potentially adding more risk than is otherwise desired. I am going to walk you through my rationale and show you how I make more optimal solutions for retirees.

Defining Risk

To start, let’s break down the word “risk.” Risk is brought up anytime investments are being discussed, and how it’s defined is a significant component to allocating money successfully. Many academics and MBA earners are going to equate risk to volatility; that is, risk is the measure of how much a particular investment’s price moves in a given day.

I don’t think of risk as volatility, and neither should you.

I think of risk as the actual measure of an investment’s underlying strengths and weaknesses; that is, how likely is to make us money versus its ability to cause permanent loss of investment. This isn’t an easy thing to calculate because it requires fundamental analysis at its core and qualitative predictions of the future at its boundary lines. Nonetheless, a talented advisor will have the wherewithal to perform this analysis for you.

Bonds v. Stocks

Bonds are debt offerings by a company. When you buy a bond, you are lending your money to a corporation, who in return pays you interest with a lump sum due at maturity. You do not receive ownership in a company when you buy a bond, so you only care about getting paid back. Bonds therefore have more limited ability to create wealth and are handicapped by inflation. Bond interest is also taxed at higher rates than stock dividends.

When you buy stock, you are buying a piece of ownership in a company, called equity. Your participation in the increase in the company’s value is the primary reason to buy stocks. While you are last in line to receive a payout if the company goes bankrupt, you have theoretically unlimited upside in wealth creation and therefore are significantly more insulated against inflation.

Stocks are believed to be riskier because they are typically more volatile due to their tie to the company’s current value. As discussed above, that means their prices tend to move around more than bonds from the same company.

The most notable difference in terms of stocks and bonds is in potential wealth creation. Poorly picked stocks are probably just as bad as poorly picked bonds, but a well-picked stock has positive impacts to wealth development that even the best picked bond can’t compete against.

Why Bonds Change in Price

The initial rate offered by a bond is typically determined by the credit quality of the issuer; a riskier company will typically offer a higher rate. Once a bond is issued, its market value is primarily dictated via buying and selling in the market, which is heavily influenced by current interest rates and time to maturity. Bonds maturing later are more sensitive to rate movements while bonds maturing in the near future become less sensitive to rate movements. This concept, known as duration, requires a well structured bond portfolio to hold a varying mix of credit quality and time to maturity.

Why Stocks Change in Price

Like bonds, stocks only move because of buying and selling activity, called trading. Stock trading is driven by the difference between price versus perceived value. Investors who believe a stock is worth more than its price will buy it while investors who believe it’s worth less than its price will sell it. While valuing a stock is an incredibly complex and often imperfect task, buying and selling, regardless of reason, solely drives stock prices.

Reasons People Prefer Bonds With Age And Why They are Wrong

At the heart of every heavy bond allocation is a fundamental fear that stocks are more likely to cause permanent loss of life savings in a bear market, forcing a retiree back into the workforce. This bias to protect gains by limiting risk is known as Prospect Theory. Let’s break down where some of this fear comes from as it relates to our stocks v bonds discussion, and why I think there are way to advise around it.

(1) Sequencing: the misunderstood risk factor

Sequencing refers to the order of financial scenarios that play out in your life. For example, a new retiree who benefits from repeated years of 20% market returns is going to have a very different experience than a new retiree who suffers repeated year of 20% market declines. Sequencing is nothing more than good or bad luck, but it’s exacerbated by poor financial planning. It’s also worth nothing that if you aren’t withdrawing from your investments, you are immune from sequencing because you have runway to recover from any paper losses you’ve incurred.

To avoid sequencing risks, it’s imperative to first have a draw-down schedule for living expenses already set up for the first 3-5 years and second to wholistically invest for long-term success. This is something a talented advisor can and should be doing for any household that is at or nearing retirement.

The biggest misconception with sequencing is that bonds always protect against bad sequences more than stocks do. This could not be further from the truth. In the 2022 stock market crash, long-term bonds collapsed 30% while stocks collapsed only 20%. Furthermore, stocks fully recovered by December 2023 while long-term bond prices are still near all-time lows. For a newly retired investor in 2022, a 60/40 portfolio would have caused a permanent loss of capital, which based on our risk definition above, is the absolute number one thing we are trying to avoid.

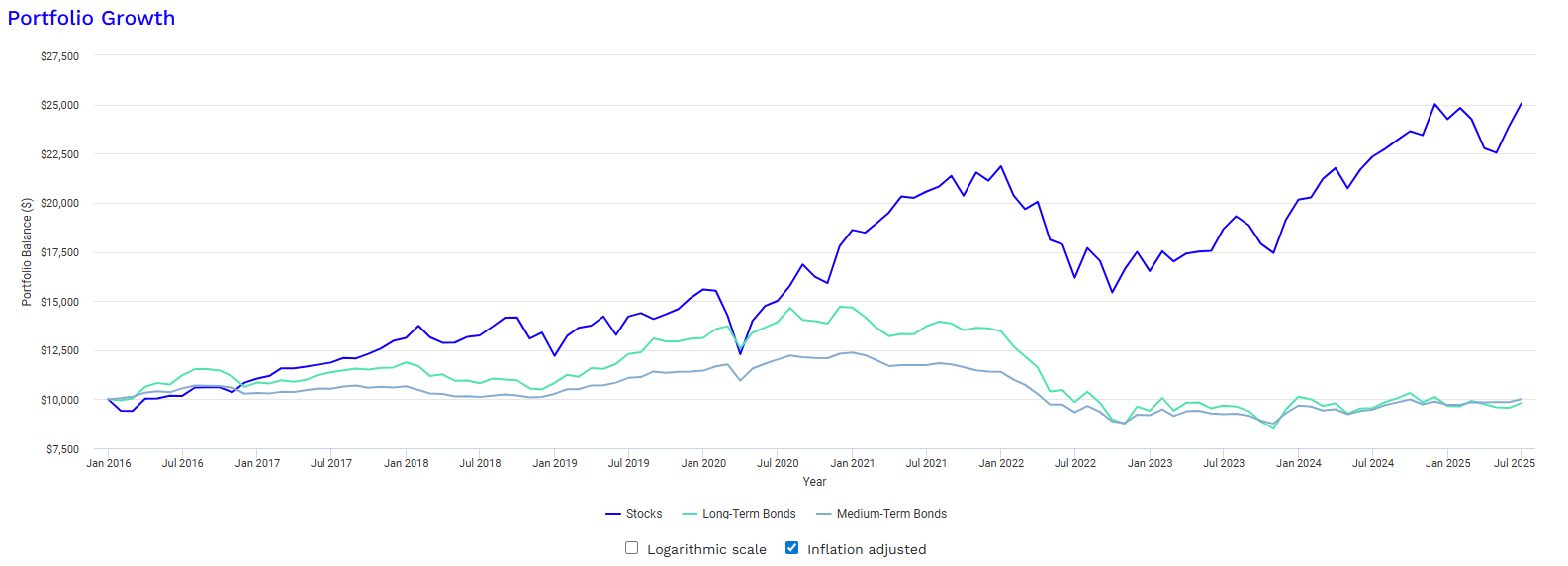

To illustrate the importance of being immunized from sequencing risk, the chart below shows a roughly 10-year run comparison of $10,000 invested in (1) stocks, (2) long-term bonds, and (3) medium-term bonds. The total return per year, including dividends and interest, is almost 14% for stocks and just 3% for bonds. You can see that the total value created from stocks (+$24,000) is more than 7x the value created from bonds ($3,300); thus, any retiree should try to be as heavily allocated to stocks as possible. The role of the advisor is to help make sure that is possible while keeping sequencing risk to a minimum. A 70/30 or 60/40 is far too conservative to achieve this objective and does a disservice to the client by reducing total returns unnecessarily.

(2) Inflation Underestimation:

Most retirees understand their bond portfolio to be one that has a steady and known return, which therefore limits their total downside risk (aka the real reason they avoid stocks). However, the primary flaw with this belief is turning a blind eye to a bond portfolio’s enemy #1: Inflation.

Inflation is tricky because it does not get measured when looking at an investment in isolation. To calculate an investment’s actual past performance, you have to look at its real return, which takes into account growth relative to spending power. In the graph below, we are comparing the same scenario as earlier but this time measuring total real return (i.e. including inflation). Notice how the bond portfolios are unchanged over nearly a decade while the stock portfolio has 150% more purchasing power than before.

(3) Risk-Reward: As we’ve discussed, many households believe bonds are inherently safer because they have known payments and are not tied to a company’s value (so long as the company stays in business long enough to pay the bond). The irony here is that because bond values have a fixed maturity value, their downside risk is actually more pronounced. In other words, you are taking on more risk relative to the reward when you choose bonds.

In financial economics, we can actually measure this phenomenon through a concept known as the Sharpe Ratio. The Sharpe ratio is a measure of return divided by risk. You want the highest Sharpe ratio possible because that means you’re getting the most return relative to the risk taken.

In our scenario set above, these are our Sharpe ratios:

Stocks: 0.76

Long-term bonds: 0.14

Medium-term bonds: 0.21

The relative comparison of the above numbers speak volumes. You are getting the 5x the return relative to the risk taken when you choose stocks over long-term bonds.

Scenario Set - Revisited

Throughout this article, we have drawn upon a decade long comparison of stocks, long-term bonds, and medium-term bonds. This decade included a number of major market events, such as the low interest rate run from 2010-2022, Covid, and the increase in rates in 2022. The table of values from that scenario shows that:

Long-term bonds had the single biggest draw down of -32% while stocks came in at -25%.

Medium-term bonds had a best single year return of 14%, which was less than half of the stock market’s best year of 31%.

Stocks created an additional $20,500 of wealth with a single $10,000 investment.

Closing Thoughts

Retirees should not flee to bond heavy allocations in an attempt to reduce the risk of losing money in retirement. Doing so would actually impair the portfolio’s total wealth creation relative to the risks taken.

While bonds returns are handicapped by inflation and don’t enjoy the equity appreciation stockholders receive in the market’s best years, they aren’t totally worthless either. The role of bonds in a retiree’s portfolio should be to help reduce sequencing risk. An ideal retiree portfolio looks something like this:

Cash and high yield savings for current year expenses

Bonds and high yield savings for years 2-5 expenses

Stocks for the remainder

Each year, we would rebalance the bond and stock allocations based on their current year performance to ensure enough cash for current year expected spending. Year-to-year fluctuations are minimized because we've already set up a diversified pool of high quality investments while never giving up the underlying stock engine delivering inflation beating performance over the long-term. The allocation decisions from year-to-year are highly variable and, as always, are ultimately a function of your spending habits and retirement goals.

2025 Retirement Plan Contribution Limits

The IRS has made notable increases to the contribution limits for 401(k)s, catch-up contributions, and HSAs in 2025.

The IRS has made some notable changes to retirement plans in 2025, including an increase to the 401(k), 401(k) catch-up, and HSA contribution amounts. A summary table is below.

In many cases, application of these rules can be tricky, especially if you’re married, in a domestic partnership, have access to multiple plans, are self-employed, or lose plan access mid-year; the nuances of these cases are not covered here.

2025 401(k), 403(b), and TSP Employee Contribution Limit

The employee contribution limit for 401(k), 403(b), and TSP plans has increased from $23,000 in 2024 to $23,500 in 2025.

The catch-up contribution for those ages 50 and older has remained steady at $7,500 in 2025, which means employees ages 50 and older can contribute up to $31,000 in 2025.

A super catch-up contribution provision was added this years for those ages 60-63. The catch-up amount for those ages increased from $7,500 in 2024 to 11,250 in 2025.

2025 401(k), 403(b), and 401(a) Total Contribution Limit

The sum of employer and employee contributions limit for 401(k), 403(b), and TSP plans has increased from $69,000 in 2024 to $70,000 in 2025.

For those ages 50 and older, if you include the catch-up contribution, the limit is $77,500. For those ages 60-63, the limit is $81,250.

2025 457(b) Total Contribution Limit

The employee contribution limit for 457(b) plans has increased from $23,000 in 2024 to $23,500 in 20245 Remember, those with access to a 401(k) and a 457(b) plan can max both plans out!

The 457(b) catch-up contribution for those ages 50 and older has remained steady at $7,500 in 2024; however, check with your plan administer to see if the “last 3-year-catch-up” provision applies.

2025 Traditional IRA and Roth IRA Contribution Limit

The contribution limits for Traditional IRAs and Roth IRAs has remained at $7,000 in 2025 (no change).

The catch-up provision for those ages 50 and older remains at $1,000 in 2025 (no change).

2025 Traditional IRA Income Phaseout Limit

For those who are unmarried without a retirement plan at work, Traditional IRA contributions are fully deductible in 2025.

For those with a retirement plan at work, the tax deductibility of Traditional IRA contributions has the following income phaseout ranges:

Single (2024): $77,000-$87,000

Single (2025): $79,000-$89,000

Married Filing Jointly (2024): $123,000-$143,000

Married Filing Jointly (2025): $126,000-$146,000

If you are married but only your spouse is covered by a retirement plan, the following phaseout range applies to you:

2024: 230,000-$240,000

2025: 236,000-$246,000

2025 Roth IRA Income Phaseout Limit

The contribution eligibility for a Roth IRA has the following income phaseout ranges:

Single and Head of Household (2024): $146,000-$161,000

Single and Head of Household (2025): $150,000-$165,000

Married Filing Jointly (2024): $230,000-$240,000

Married Filing Jointly (2025): $236,000-$246,000

2025 Health Savings Account (HSA) Contribution Limits

The 2025 single contribution limits for HSA plans has increased to $4,300 from $4,150 in 2024.

The 2024 family contribution limits for HSA plans has increased to $8,550 from $8,300 in 2024.

The HSA catch-up provision for those ages 55 and older remains at $1,000 for singles and $2,000 for families in 2024. Remember that for families, each partner may put $1,000 of catch-up contribution into their own individual HSA, but not into the same HSA, for a total of $2,000.

2025 Flexible Spending Account (FSA) Contribution Limits

The 2024 healthcare FSA contribution limit has increased to $3,300 from $3,200 in 2024.

Please don’t confuse FSA plans with dependent care FSA plans; these are not the same thing.

2025 SEP IRA Contribution Limits

The SEP IRA limit has increased from $69,000 in 2024 to $70,000 in 2025. Remember, SEP IRA contributions can only be made by the employer.

SOURCE: https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

2024 Retirement Plan Contribution Limits

The IRS has made notable increases to the contribution limits for 401(k)s, IRAs, and HSAs in 2024.

The IRS has made some notable changes to retirement plans in 2024, including an increase to the 401(k), IRA, and HSA contribution amounts. A summary table is below.

In many cases, application of these rules can be tricky, especially if you’re married, in a domestic partnership, have access to multiple plans, are self-employed, or lose plan access mid-year; the nuances of these cases are not covered here.

2024 401(k), 403(b), and TSP Employee Contribution Limit

The employee contribution limit for 401(k), 403(b), and TSP plans has increased from $22,500 in 2023 to $23,000 in 2024.

The catch-up contribution for those ages 50 and older has remained steady at $7,500 in 2024, which means employees ages 50 and older can contribute up to $30,500 in 2024.

2024 401(k), 403(b), and 401(a) Total Contribution Limit

The sum of employer and employee contributions limit for 401(k), 403(b), and TSP plans has increased from $66,000 in 2023 to $69,000 in 2024.

For those ages 50 and older, if you include the catch-up contribution, the limit is $76,500.

2024 457(b) Total Contribution Limit

The employee contribution limit for 457(b) plans has increased from $22,500 in 2023 to $23,000 in 2024. Remember, those with access to a 401(k) and a 457(b) plan can max both plans out!

The 457(b) catch-up contribution for those ages 50 and older has remained steady at $7,500 in 2024; however, check with your plan administer to see if the “last 3-year-catch-up” provision applies.

2024 Traditional IRA and Roth IRA Contribution Limit

The contribution limits for Traditional IRAs and Roth IRAs has increased from $6,500 in 2023 to $7,000 in 2024.

The catch-up provision for those ages 50 and older remains at $1,000 in 2024.

2024 Traditional IRA Income Phaseout Limit

For those who are unmarried without a retirement plan at work, Traditional IRA contributions are fully deductible in 2024.

For those with a retirement plan at work, the tax deductibility of Traditional IRA contributions has the following income phaseout ranges:

Single (2023): $73,000-$83,000

Single (2024): $77,000-$87,000

Married Filing Jointly (2023): $116,000-$136,000

Married Filing Jointly (2024): $123,000-$143,000

If you are married but only your spouse is covered by a retirement plan, the following phaseout range applies to you:

2023: 218,000-$228,000

2024: 230,000-$240,000

2024 Roth IRA Income Phaseout Limit

The contribution eligibility for a Roth IRA has the following income phaseout ranges:

Single and Head of Household (2023): $138,000-$153,000

Single and Head of Household (2024): $146,000-$161,000

Married Filing Jointly (2023): $218,000-$228,000

Married Filing Jointly (2024): $230,000-$240,000

2024 Health Savings Account (HSA) Contribution Limits

The 2024 single contribution limits for HSA plans has increased to $4,150 from $3,850 in 2023.

The 2024 family contribution limits for HSA plans has increased to $8,300 from $7,750 in 2023.

The HSA catch-up provision for those ages 55 and older remains at $1,000 for singles and $2,000 for families in 2024. Remember that for families, each partner may put $1,000 of catch-up contribution into their own individual HSA, but not into the same HSA, for a total of $2,000.

2024 Flexible Spending Account (FSA) Contribution Limits

The 2024 healthcare FSA contribution limit has increased to $3,200 from $3,050 in 2023.

Please don’t confuse FSA plans with dependent care FSA plans; these are not the same thing.

2024 SEP IRA Contribution Limits

The SEP IRA limit has increased from $66,000 in 2023 to $69,000 in 2024. Remember, SEP IRA contributions can only be made by the employer.

2024 SIMPLE IRA and Simple 401(k) Contribution Limits

The SIMPLE IRA and SIMPLE 401(k) contribution limit has increased from 15,500 in 2023 to $16,000 in 2024.

The 2024 SIMPLE IRA catch-up contribution has remained steady at $3,500.

SOURCE: https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000#:~:text=Highlights%20of%20changes%20for%202024,to%20%247%2C000%2C%20up%20from%20%246%2C500.

How Professional Investors Create Portfolios of Undervalued Stocks

What is the basic strategy for building portfolios of undervalued stocks?

Some of the greatest investors of our time have been known to find stocks at a bargain to generate large returns over time: Warren Buffett, Phil Fisher, and John Templeton come to mind. While the task is by no means easy, creating a portfolio of undervalued stocks can be a good way to potentially earn higher returns, as undervalued stocks may be priced lower than their intrinsic value and have the potential to increase in value as the market recognizes their true worth. However, finding undervalued stocks can be challenging because it requires requires careful analysis, the right tools, and patience. In addition, investments sometimes don’t pan out like people think, and it’s easy to fall into value traps (thinking there is value where there really isn’t).

Here are some steps you can follow to create a portfolio of undervalued stocks:

Research companies: Start by researching companies that you are interested in investing in. Look for companies with strong financials, such as consistent revenue growth, a healthy balance sheet, and a track record of profitability. John Templeton always said that you should focus on the future of a company, not just what it’s doing in this very moment.

Analyze financial statements: Look at the company's financial statements, including its income statement, balance sheet, and cash flow statement, to get a better understanding of its financial health and performance. Look for red flags, such as declining revenues or increasing debt, that could indicate that the company is not performing well. For most investors, financial statements are a barrier to entry because it requires some proficiency in accounting to understand.

Compare the stock's price to its intrinsic value: Use financial ratios, such as the price-to-earnings ratio (P/E) or the price-to-book ratio (P/B), to determine if the stock is undervalued. If the stock's price is lower than its intrinsic value, it may be considered undervalued. However, keep in mind that earnings can be calculated in a variety of ways, so you can’t just use one method and call it a day. Cash flow is just as, if not more, important.

Consider the company's industry and macroeconomic conditions: Consider the company's industry and the broader economic conditions. A company may be undervalued due to temporary setbacks or challenges that are specific to its industry, rather than due to fundamental problems with the company itself. Betting on the macro environment has proved all but impossible, and many businesses are phased out over time; this is particularly true of the tech sector. Thus, it’s important to consider monetary policy, fiscal policy, and secular trends when choosing your investments.

Diversify your portfolio: It’s not enough to know one specific industry. It's important to diversify your portfolio to spread risk across different types of assets and industries. Consider including a mix of undervalued stocks, as well as other types of investments, such as bonds, real estate, and cash.

Remember that investing carries risk, and it's important to carefully consider your risk tolerance and investment goals before making any investment decisions. It's always a good idea to seek the advice of a financial professional before making any investment decisions. At Park 64 Capital, we set up portfolios with strong fundamentals to help investors reach their long-term goals.

Kelly Betting: How Much to Invest in a Stock

The Kelly Bet Criterion describes a mathematical technique to allocate your investments optimally.

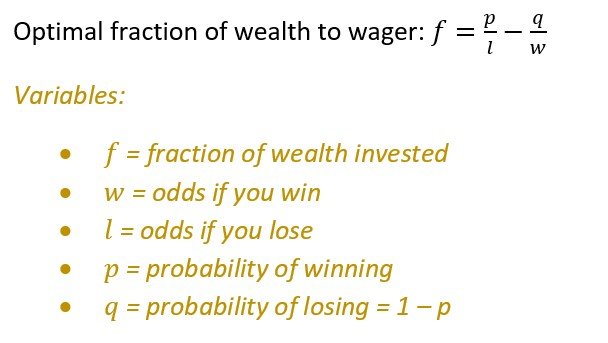

Sizing stock market positions is a difficult challenge. It’s arguably the hardest thing an investor has to do after selecting the investment itself. You might be surprised to learn that there is a theoretical way to optimize an investment allocation, called the Kelly Betting Criterion. The Kelly Betting Criterion was created by a brilliant scientist in mid 20th century named John Kelly. Despite it’s convincing proof, Kelly Betting has some limitations and therefore other considerations must be made when sizing up stock allocations. Let’s dig into the how and why behind this neat little formula.

What is a Kelly Bet?

A Kelly Bet is a mathematical formula used to size investments for the most optimal growth rates as the number of investments approaches infinity. This growth rate is a function of the fraction of wealth invested, the probability of winning, and the odds at stake. For example, consider a wager with a 2:1 payout where you win 60% of the time. Your expected gain on a wager requiring $10 to enter is $8 (2 x $10 x 60% - 1 x $10 x 40%). A casino would never offer this game to you because they’d lose $8 each time on average. That’s easy to understand, but what’s harder to determine is how much of your life savings you’d put into this same wager if you could repeat it ad nauseum.

You know the above wager has positive expected value, but you also know you’ll lose some of the time. For example, if you bet your entire life savings on a single wager and lose, you go broke. Similarly, too small of a bet is counterproductive to making wealth fast enough; this is would be similar to holding most of your wealth in cash.

Now let’s consider an investment with the same wager as described above but under the assumption you have a $1M total portfolio. How much should you invest of that $1M to grow your portfolio optimally? We solve this using the following equation:

Plugging in the numbers from our example, we can see that betting $400,000, or 40% of our wealth, is the solution. In other words, f = 0.60 / 1 - 0.40 / 2 = .40 = 40%.

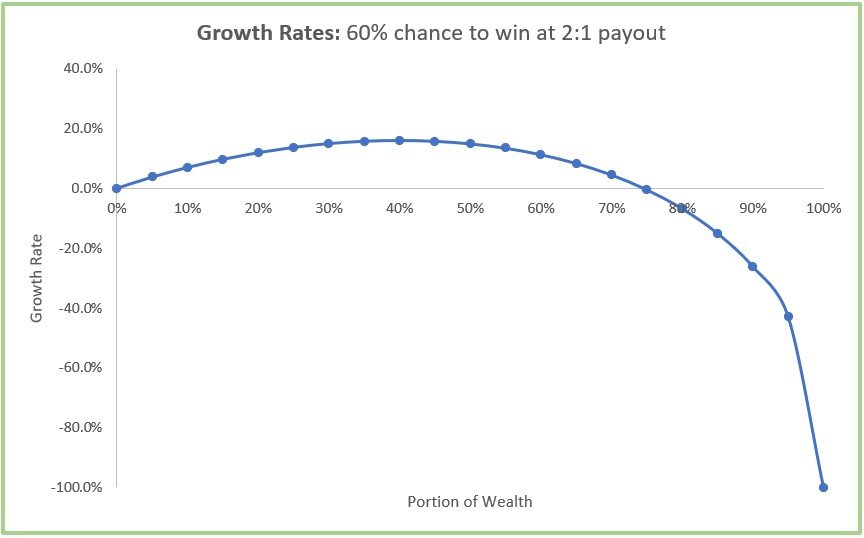

The growth rates over the possible range of wealth percentage wagers is shown graphically below. Interestingly enough, there is an inflection point at 75%, where wagering that amount or higher gives you a negative growth rate (this is true despite having a positive expected value of $0.80/dollar, as mentioned earlier. You can also see that wagering 100% of your wealth on a single investment leads to a growth rate of -100%; this should make sense. Even if you’re right about the first 100 investments, it only takes one to ruin you in this particular case.

The Kelly Criterion has meaningful consequences as it relates to investment. Notably, even if we think we have an investment with a 2:1 payout and a 60% chance of winning, we still can’t safely bet the farm on it because it’s not the most optimal way to grow our portfolio. We also know that we have to diversify because it’s suboptimal to excessively allocate to a single position.

Why the Kelly Bet Might Not Even Matter

I would contend that the Kelly Betting Criterion is a useful tool to humble one’s confidence and codify the need for diversification (which is typically justified using Modern Portfolio Theory). However, the Kelly Betting Criterion does have a number of limitations that prevent it from being used with any sort of nontrivial level of precision:

There’s no way to know the numerical probability of winning with an investment. The best one can do is thoroughly research to make a yes or no decision.

Investing odds aren’t clear. For the most part, quality stocks don’t go to zero nor can they grow forever. There are discounted cash flow methods I use to create upside vs. downside levels, but there are still a great number of uncertainties in investment that make it impossible to know if something is 4:2 or 4:1.25, for example; the difference would change an allocation meaningfully.

Kelly Betting assumes infinite repeats of a bet; in reality, an investor has a more limited time frame to grow their wealth.

Allocation is tricky because it remains an area of art, science, and experience.; the Kelly Bet criterion is just one tool in the toolbox of understanding. Allocation also requires confidence, humility, and discipline. Investments need to be scaled in proportion to goals, timelines, confidence, risk capacity, and a host of other factors. ETFs can be held in greater proportions than stocks, of course, but it behooves the investor to know the components held in the ETF to ensure the underlying securities are of proper ilk to meet the desired growth rate objectives.

If you’re interested, I’ve included a proof of the Kelly Bet below. It does require elementary calculus to understand fully.

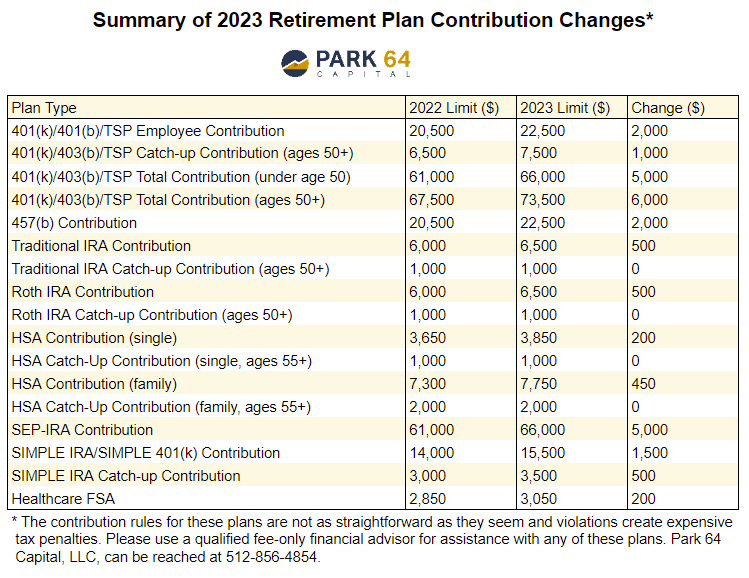

2023 Retirement Plan Contribution Limits

This post contains the 2023 contribution limits for 401(k), 403(b), IRA, HSA, FSA, SIMPLE IRA, and SEP IRA plans

Inflation has been hovering north of 7% for the entirety of 2022, which has given the IRS leeway to increase the limits for some of the most common retirement plans in 2023: 401(k)s, 403(b)s, TSPs, 457(b)s, HSAs, FSAs, SIMPLE IRAs, and SEP IRAs. Unlike 2022, the IRS actually did increase the Traditional IRA and Roth IRA contribution limits in 2023. The announcement for qualified plans was made official by the IRS in Notice 2022-55. A summary table is below.

In many cases, application of these rules can be tricky, especially if you’re married, in a domestic partnership, have access to multiple plans, are self-employed, or lose plan access mid-year; the nuances of these cases are not covered here.

2023 401(k), 403(b), and TSP Employee Contribution Limit

The employee contribution limit for 401(k), 403(b), and TSP plans has increased from $20,500 in 2022 to $22,500 in 2023.

The catch-up contribution for those ages 50 and older has increased from $6,500 in 2022 to $7,500 in 2023, which means employees ages 50 and older can contribute up to $30,000 in 2023.

2023 401(k), 403(b), and 401(a) Total Contribution Limit

The sum of employer and employee contributions limit for 401(k), 403(b), and TSP plans has increased from $61,000 in 2022 to $66,000 in 2023.

For those ages 50 and older, if you include the catch-up contribution, the limit is $73,500.

2023 457(b) Total Contribution Limit

The employee contribution limit for 457(b) plans has increased from $20,500 in 2022 to $22,500 in 2023. Remember, those with access to a 401(k) and a 457(b) plan can max both plans out!

The 457(b) catch-up contribution for those ages 50 and older increased from $6,500 in 2022 to $7,500 in 2023; however, check with your plan administer to see if the “last 3-year-catch-up” provision applies.

2023 Traditional IRA and Roth IRA Contribution Limit

The contribution limits for Traditional IRAs and Roth IRAs has increased from $6,000 in 2022 to $6,500 in 2023.

The catch-up provision for those ages 50 and older remains at $1,000 in 2023.

2023 Traditional IRA Income Phaseout Limit

For those who are unmarried without a retirement plan at work, Traditional IRA contributions are fully deductible in 2023.

For those with a retirement plan at work, the tax deductibility of Traditional IRA contributions has the following income phaseout ranges:

Single (2022): $68,000-$78,000

Single (2023): $73,000-$83,000

Married Filing Jointly (2022): $109,000-$129,00

Married Filing Jointly (2023): $116,000-$136,000

If you are married but only your spouse is covered by a retirement plan, the following phaseout range applies to you:

2022: 204,000-$214,000

2023: 218,000-$228,000

2023 Roth IRA Income Phaseout Limit

The contribution eligibility for a Roth IRA has the following income phaseout ranges:

Single and Head of Household (2022): $129,000-$144,000

Single and Head of Household (2023): $138,000-$153,000

Married Filing Jointly (2022): $204,000-$214,000

Married Filing Jointly (2023): $218,000-$228,000

2023 Health Savings Account (HSA) Contribution Limits

The single contribution limits for HSA plans has increased from $3,650 in 2022 to $3,850 in 2023.

The family contribution limits for HSA plans has increased from $7,300 in 2022 to $7,750 in 2023.

The HSA catch-up provision for those ages 55 and older remains at $1,000 for singles and $2,000 for families in 2023. Remember that for families, each partner may put $1,000 of catch-up contribution into their own individual HSA, but not into the same HSA, for a total of $2,000.

2023 Flexible Spending Account (FSA) Contribution Limits

The 2023 healthcare FSA contribution limit has increased from $2,850 in 2022 to $3,050 in 2023.

Please don’t confuse FSA plans with dependent care FSA plans; these are not the same thing.

2023 SEP IRA Contribution Limits

The SEP IRA limit has increased from $61,000 in 2022 to $66,000 in 2023. Remember, SEP IRA contributions can only be made by the employer.

2023 SIMPLE IRA and Simple 401(k) Contribution Limits

The SIMPLE IRA and SIMPLE 401(k) contribution limit has increased from 14,000 in 2022 to $15,500 in 2023.

The SIMPLE IRA catch-up contribution has increased from $3,000 in 2022 to $3,500 in 2023.

SOURCE: https://www.irs.gov/newsroom/401k-limit-increases-to-22500-for-2023-ira-limit-rises-to-6500

Why Stock Prices Go Up and How to Make Great Investments

This post explains why stock prices change and how to be a great investor.

People as a whole are poor capital allocators. Being a cutting-edge neurosurgeon, a brilliant CPA, or a savvy programmer does not provide the skillset required to be long-term successful in markets. What does then? Before we dig into that, we need to first understand why stocks go up in the first place. On the surface, this feels like an extremely complicated question, and you may even be wondering if I’m trying to trick you. No tricks today. The answer is surprisingly simple:

Stock prices go up when there are more buyers than sellers.

Stock prices go down when there are more sellers than buyers.

Valuation, growth prospects, profitability, and the macro environment are nothing more than signals to bring buyers and sellers to the market. Ostensibly, not all signals are corresponded to rationally; for example, a fantastic earnings report may result in a stock price decline. Why would people sell off a company who posted strong results?! It might surprise you to know that stocks trade based on what is expected to happen in the future, so the alignment of earnings against expectations is what ultimately matters. When future expectations are used as the yardstick for pegging stock prices, short-term volatility is a corollary.

If you knew which days buyers were going to outnumber sellers, you’d have found the holy grail to stock market investing; you’d make money on every trade! It suffices to say that many have tried to build analytical models and systems to predict market direction. Unfortunately, those systems tend to work until they don’t. There are too many variables involved, including emotions themselves, that incentivize people to buy and sell securities. Market prediction mechanisms are more apt to lull an investor into a false sense of security than create meaningful and consistent profits.

The randomness of stock price movements is referred to as Brownian motion. The classic example of Brownian motion is dropping a single bead of food coloring into water and trying to predict where it will go. Hot and cold water, much like the macro environment, will impact the rate of movement, but the actual movement is inherently random.

Brownian motion at work

If markets are indeed random, what odds does that leave for an investor who is trying to build a retirement portfolio? If, after all, stock trading is nothing more than spinning a roulette wheel each day, why not build your retirement at the casino? The truth of the matter is that all short-term movements in the stock market are random, but long-term movements, while still having many unknowns, are much more predictable if you know how to do the proper analysis. Analysis is complex, imperfect, and can be summarized as the act of increasing sets of known information while reducing sets of unknown information until a conclusion regarding an investment can be reached.

Earlier, I mentioned that most people are not successful in making money in markets over the long-term. This is because most people are either traders or other ill-equipped investors. Let’s take a quick look at the difference between a trader and an investor to better understand why.

Trading vs. Investing

These two words get mixed up a lot and in most situations, they can be used interchangeably without any need for correction. But it’s important to differentiate trading from investing for the intents and purposes of this entry.

Trading: Placing a bet on a stock

Investing: Placing a well-educated bet on a stock

Notably though, not all investments are long-term and not all trades are short-term. A trader is making a decision based on emotions, prior price movements, or an idea that lacks sound qualitative and/or quantitative fundamental reasoning. A key difference in investment is the research of various imperatives to determine that there is a substantial chance for material gain relative to material loss; I like to call this differential the asymmetric upside of an opportunity. Proper research also provides the right framework to make better decisions as more information becomes available over time. While even the best investors are occasionally wrong, the successful ones are good not only at making money but also at not losing it. Furthermore, an investor can tolerate a position moving against them for a very long time, assuming the underlying reason for investment has not changed and another more appealing, alternative opportunity has not come onto the scene.

Think of the difference between trading and investing like the difference between Blackjack (trading) and Poker (investing).

In Blackjack, you start every hand with zero information and are simply wagering what you think you can afford to lose; the odds are stacked against you. The dealer will even help you make better decisions, and the drinks may soon become free. Just like your stock broker who wants to keep you trading, the casino wants to keep you playing. Any short-term success will eventually succumb to the inevitability of probable losses if you stick around for long enough. The bid-ask spreads also rack up in trading, a common complaint among those who advocate against selling order flow.

In Poker, on the other hand, each hand brings a series of knowns and unknowns, and you can immediately fold your hand at minimal investment. There are an incredible amount of datapoints that emerge throughout each hand: cards, player styles, bluffs, probabilities, bet sizes, etc. This puts you in the driver seat, allowing you to make bigger bets when the odds are in your favor; and perhaps more importantly, to cut your losses when the status quo becomes unfavorable. And no matter how good you are at Poker or investment, you may still lose even when the odds to win are heavily in your favor, something Poker players call a bad beat.

There are still two grey areas in the differentiation of a trader and an investor:

Time: If a trader holds a poorly researched position for years, are they an investor by fiat?

Sufficiency: How much information must one have to support a position to be considered an investor vs a gambler?

The nuance begged by the above two questions probably doesn’t even matter; those who hold poorly researched positions, even over a long time horizon, are going to make more human judgment errors, resulting in suboptimal asset accumulation over extended periods of time.

How to Be a Successful Investor

Being an above-board investor is incredibly difficult because it requires a massive time commitment to do things that most would consider extremely boring. As mentioned earlier, an investment skillset is very similar to that of a Poker player: long hours of grinding away until the right opportunity strikes; then, careful movement in and out of it. When done this way, long-term stock market success becomes much more predictable; of course, short-term movements are still random, and no market participant wins every single time; therefore, the investor is burdened with sizing his positions accordingly.

The skills to be a superb investor are difficult to define, but here are some of the more basic requirements:

Know the goals of your portfolio. You can’t allocate if you don’t know what you’re targeting.

Look for ideas everywhere. Every 100 ideas probably only has 1 or 2 good leads.

Read the stock’s respective SEC 10-K and 10-Q and have a fundamental understanding of income statement, balance sheets, and cash flows analysis.

New information can’t be ignored. Risk/return trade-offs can change in an instant.

Having exit criteria going in is important; otherwise, how do you know when to increase your bet or cut your losses?

Know how to size your bets. I’ll post another article on this later, but this is a major differentiator between good and bad investors. It’s more mathematical than you might think!

Leveraging an experienced and talented investment advisor can give you instant access to a propitious long-term portfolio without having to commit time and energy to learning a skillset that takes years of careful study to develop with no guarantee of having the knack for it. Pairing with an advisor is one of the best ways to make the most of your career earnings. Unfortunately, most people tend to delay the process until later in life, which subsequently delays their retirement goals.

Your Economics Teacher Gaslighted You, and Why Inflation Keeps Increasing

Inflation is red hot. This is why.

October 2022 - The U.S. economy is in a recession: two consecutive quarters of declining GDP are all that is required.

In a recession, we typically see a decline in interest rates and inflation rates. Ironically, we are seeing the exact opposite:

August 2022, inflation: 8.30%, from 1.30% two years ago

September 2022, 30-year mortgage: 7.00%, from 3.00% two years ago

September 2022, 10-year treasury: 3.80%, from 0.75% two years ago

If you’re confused about why America and the rest of the world is in such a flux right now, you’re not alone. We can’t merely blame Covid, Russia, or China either. While there is some part to be played by globally impactful events, there is another key reason that America seems to be flipped over on her head.

Inflation as of August 2022

How the Economy Works: 101

The economy cycles from expansion to contraction. Think of this like state changes over time that range from very good to very bad. Not all expansions are exuberant and not all contractions are painful. The year 2022 is one of those notable contractions that is very painful.

During expansion:

During expansion, things are great! You don’t hear many complaints from your neighbor, and everyone seems to be winning on all fronts: employment is high, housing markets are extremely competitive, stock markets seem to give free money, and startups grow like weeds.

Generally speaking, in expansionary economies:

Businesses grow - because there is money for the taking

Interest rates rise - because corporations are demanding more investment dollars

Jobs are created - because corporations need more labor

Spending rises - because people have more money

Inflation rises - because demand for goods and services increases

During contraction:

We all know that people tend to go too far and then overcorrect, so it goes without saying that all expansions come to an end in some fashion. During a contraction, consumer spending growth slows and consumer savings start to rise as interest rates become more attractive. As a corollary, production falters as demand for products declines.

Contractions are easy to spot — when you start to hear stories on the news about people losing their jobs and not being able to buy their kids tons of Christmas presents, you’re in a contraction.

Generally speaking, in contractionary economies:

Businesses decline- because there aren’t enough additional profits to justify expenditures

Interest rates fall - because corporations aren’t demanding dollars to grow

Jobs are lost - because companies don’t need the extra labor anymore

Spending declines - because people have less money

Inflation falls - because demand for goods and services decreases

Why interest rates fall during contraction:

In a free market economy, interest rates should fall when corporations are becoming more hesitant to borrow (i.e. sell bonds) due to a glut of either inventory or labor or both. As a corporation’s desire to borrow decreases, so does the interest rate they’re willing to pay to do so. This interest rate lowering affect usually begins at the peak of an expansionary period and signals a contraction on the horizon.

Did Your Economics Teacher Gaslight You?

While we can say that America is in a recession from a technical definition, does it really feel that way? There is only a slight increase in unemployment (left graph below) and the number of workers is still growing (right graph below). We are starting to see some layoffs and hiring freezes, notably at certain big tech firms such as Facebook; yet, decent jobs can still be found with reasonable effort.

According to theory, a contracting economy brings job losses, declines in spending, declines in interest rates, and declines in inflation. But as of October 2022, we’re seeing increasing interest and inflation rates paired with a stalled out, or arguably declining, economy.

So is economic theory just a pack of lies your former teacher told you to sound smart, or is there any hint of truth to it? To understand why increasing interest and inflation rates can coexist in a stagnant economy, let’s take a hard look at the most powerful market manipulator of the 21st century: the Federal Reserve Board.

The Federal Reserve Board is Killing Your 401(k)

From 2008-2021, the Federal Reserve Board (the FED) has been working in conjunction with the United States Treasury to increase the money supply, a process called quantitative easing (QE). During QE, the Federal Reserve Board purchases government bonds from banks. This has a stimulatory effect on the economy because it increases the banks’ reserves and therefore makes it easier for those banks to lend at more favorable terms, resulting in the growth and expansion of American businesses. While QE is useful to stimulate an otherwise declining or stagnant economy, it is a powerful tool that flies in the face of a free market economy.

Money supply in America

During QE:

The FED is lending to the economy - this is stimulatory

Stock prices rise - because businesses can grow so much more when money is cheap

Bond prices rise - because the FED adds to bond demand

Interest rates fall - because the FED is such a willing lender, the banks can pay lower interest rates

By manipulating interest rates to artificially low levels, the FED never allowed the U.S. to recover organically from the 2008 market crash. The FED essentially propped up American businesses with free money, so the true market rate of interest could not be found. It has done this over and over again from 2008 to 2022. In March of 2020, for example, the FED increased its asset purchases by $1.50 trillion and then added another $500 billion four days later.

The good part about QE is that it allows the economy to grow and expand to levels it otherwise couldn’t, much like an athlete taking anabolic steroids. However, the downside is that inflation will eventually run rampant because people have too much money to spend. The FED had historically navigated the inflation issue well and kept it stable from 2008-2021. But it’s very tenable that the downstream effects of Covid lockdowns were the straw that broke the camel’s back.

Now, in 2022, the FED has removed its support of the QE program to thwart inflation. It is instead selling government bonds back to banks, a process called quantitative tightening (QT). In QT, interest rates rise because the FED is flooding the market with a newfound demand for dollars. QT increases interest rates and simultaneously pulls money out of the system. The idea here is that by increasing interest rates via QT, stock markets will crash, home prices will fall, and eventually people will stop spending money; inflation should decrease as a corrolary.

During QT:

The FED is borrowing from the economy - this is dampening

Stock prices fall - because businesses can’t grow as quickly when money is in short supply

Bond prices fall - because the FED is selling off the government bonds it previously purchased

Interest rates rise - because the FED is such a willing borrower, the banks can charge higher interest rates

What about Inflation?

The strange part about all this, again, is that expansions should bring about rising inflation, which should naturally bring about higher interest rates until, at some point, the contractionary cycle should begin. But because the FED has been laying on the economic gas pedal in the form of QE for so long, interest and inflation rates are rising in the face of the 2022 economic slowdown, which creates an even more harmful contraction.

It’s worthy to note that this contractionary cycle was inevitable; it was a always a question of “when” not “if.”

Think of the economy like a pendulum. If you swing too far in the direction of QE, the pain of QT is going to feel even worse.

What Next?

It’s very likely that America is in for a bit more economic trouble over these next couple of years as QT runs its course. But trying to guess what the FED will do next is a fool’s errand; therefore, it’s still a good idea to stay long-term oriented with your financial plans and investment portfolio.

At some unknown point, the process of QE will likely begin again, creating another spectacular growth period in America. Or, perhaps the Federal Reserve Board will learn its lesson and retire the QE program altogether, letting the free market decide the appropriate interest rates to pay.

Only the future will tell, and it’s very uncertain.

Is Buying Land a Good Investment?

This post discusses the critical elements that should be reviewed before making a land investment.

Does land make a good investment?

Whether for a future homesite or commercial endeavor, owning land is a fantasy we’ve all had at one point or another; land is clay waiting for our sculpting hands.

But land is arguably the most intimidating real estate endeavor, quite simply because it requires more work and has more unknowns than the average buyer is looking to inherit. Land in already desirable areas is also very scarce, which means a lot of land investing requires you to see value where others don’t, be right about it over time, and justify the economics behind your ideas. These are big (ok, enormous) undertakings for an average buyer unless they’re already equipped with a talented real estate broker, tax professional, and financial planner.

In today’s post, I’m going to discuss a few critical elements to review while looking for your ideal piece of land. But as you’re reading, keep in mind that land investing is extremely risky and requires a massive due diligence process that exceeds the details discussed here.

Establish Attractiveness

The first thing to do with any land plot is to evaluate the overall feeling you get from the land. Read your instincts and be mindful of your optimism. Drive out there, walk the property twice, smell and look around; is this the one?

Next, ask some basic questions. For example:

Can I afford it?

How easy is it to access the land?

Do I like the location?

What else is nearby?

Do the neighbors look respectful?

How flat is the land?

Is this land elevated or depressed relative to its surroundings?

What is the soil like?

Does the city protect the wildlife here?

Is this on a wetland or near a major body of water?

What are the current taxes?

The list above is by no means exhaustive, but it does offer some relevant questions to make sure any further research is worth the effort.

Easements

Easements are physical, and sometimes unmarked, sections carved out of your property that you cannot develop because they are reserved for other resources, such as utilities or sidewalks. For example, most properties have a boundary along the property that you cannot build upon, usually somewhere between 10ft to 30ft. To make sure your easements are accurate, you need to review the property survey. Older surveys may lack the required details, so getting an updated survey can often be a critical contingency in your offer.

Some properties include easements for utilities, which renders the land unbuildable and/or requires the utility company unrestricted access to those portions of your lot. For example, power lines may run through your backyard or portions of your land could be sequestered for drainage. In the image below, those large dotted circles are drainage areas that can’t be built upon and the smaller solid circles (T9-T13) are protected trees that can’t be removed.

Utilities and MUDs

Speaking of easements, access to utilities is another consideration. Here some thought questions:

Water: Do I need to dig a well to get water? Not all properties have access to city water.

Sewage: Do I need a septic system? A septic tank is found in households that aren't served by municipal sewers.

Electricity: How will the property be served by electricity?

Are the property taxes reflecting additional costs for utility access via municipality utility districts (MUDs)?

MUDs are projects that build utilities with borrowed funds; the bonds are paid down by homeowners via property tax assessments. Because MUDs are funded via debt and are shared by all respective homeowners, assessments will vary over time according to property values and remaining debt levels.

Zoning

Each city has zoning restrictions, which define the allowed activity on the lot. Zoning is important because it protects you from both neighbors and developers. For example, it would be financially devastating to buy a single family home only to see a developer come in and start tearing down nearby homes to build an RV park; this is but one of many horror stories my real estate broker has shared with me!

Zoning varies by location, but will typically be defined like this:

No Zoning

Single Family Homes (large or small)

Multi-family Homes (low, moderate, or high density)

Commercial office

Light industrial

Major industrial

Mixed use

Agricultural

Historic

Each zoning type has pros and cons. For example, you can’t convert a single family home to a duplex to make revenue. Likewise, you’ll have difficulty modifying historically zoned sites because they’re highly regulated by the respective city.

Deed Restrictions

Deed restrictions are covenants that define what a homeowner can and cannot do; they are more specific and nuanced than zoning restrictions.

Restrictions can be a blessing in disguise by shielding you from neighbors who do things that destroy property values. Many deeds restrict the use of firearms, fireworks, animal agriculture, junk collection, and commercial operations. This gives you protection from a neighbor who suddenly decides that running a commercial pig farm or noisy scrap yard in their backyard is an A+ idea.

Some neighborhood restrictions can be a headache though. For example, if your goal is to build a second home for your aging parents, a restriction may prevent the use of a second structure and/or mobile home from sitting on the lot. Likewise, some covenants may restrict your ability to raise a few chickens in the backyard, even though your enterprise is small and has no profit motive.

Ultimately, the most important point is to make sure that the property you’re purchasing doesn’t have deed restrictions that invalidate your intended use while also protecting you from bad neighbors.

Nearby Properties

Nearby properties tell you a lot about how much you’ll enjoy your land and what sort of resale price it may have in the future. Any pre-existing structures as well as easements, zoning, and deed restrictions of nearby properties can help you assess the quality of the land you’re researching.

Proceed with caution when you see such things as:

Train tracks: Noise, even late at night.

Commercial operations: Pollution, water contamination, loud noises, and nauseating smells.

Rivers and streams: Increases the risk of flooding

Unsightly neighbors: Dumping trash or leaving rusted, broken down cars in their front yard.

Floodplains

Over 50% of homes flooded by Hurricane Harvey were outside of 100-year floodplains. While it may not be uncommon for a 5+ acre lot to have a small area where flooding may occur, it’s extremely important you understand your intended development and make sure the price you’re paying is worth it relative to the flood risk. FEMA has flood maps you can find here.

Being in a floodplain will also increase your flood insurance premium rates.

The floodplain of nearby properties should also be explored. Nearby rivers and streams may increase the risk of flooding. A smaller but still possible risk is that a neighbor develops (or has already developed) their land such that it diverts more water to your property than your research would indicate.

Building Costs

If you intend to build on your lot, the costs of land clearing, utility connection, building materials, and labor may change your plans dramatically. As build costs soar to $275-$300 per square foot in 2022, the economics of buying land to build make less and less sense. In addition, cities often require builders to do uneconomical things, such as getting permits, planting trees, or building drainage structures due to landscape modifications.

The overall point I’m trying to make here is that land is about much more than just the price you pay. You need to factor in all the extra costs that come with it to bring your idea to life.

Land Loans

Because land represents a greater risk to a lender than a home mortgage, land loans are significantly more expensive:

Monthly payments are determined based on a 20-year amortization schedule with a final balloon payment due in the 10th year.

Interest rates are typically 1% to 2% higher than a home mortgage and have adjustable rates.

A land loan isn’t necessarily a deal breaker, but it’s important to recognize that a lender is really pushing you to develop the land because that brings down their risk dramatically. When you do acquire additional funds to develop the land, you’ll incur additional fees to refinance the land loan. Cash closing the land and using financing for your homesite or commercial development project reduces financing charges; albeit, it requires much large funding upfront.

Closing Thoughts

Hopefully this mini guide was helpful to put some context around the sort of tasks required to buy a piece of land. It’s impossible to take every risk off the table, but there is a huge amount that can be done to lay the foundations for successful land investing. As mentioned earlier, working closely with a team consisting of a real estate broker, tax professional, and financial planner is essential to making the most of your capital resources.

Disadvantages of the Roth IRA

This post discusses the disadvantages of the Roth IRA, a popular retirement savings vehicle.

Since their inception in 1998, Roth IRAs have exploded in popularity. Roth IRAs offer tax-deferred investment growth as well as tax-free distributions, provided you meet certain eligibility requirements. In addition, there are no RMDs on Roth IRA accumulations, so you can hold the account value for life, making it a meaningful part of your estate planning strategy.

While the advantages of a Roth IRA are more easily understood and promoted, the disadvantages are rarely discussed. Not all of these downsides are dealbreakers, but they are high on any financial advisor’s list when thinking about how a Roth IRA fits into the context of the wholistic planning strategy for an individual or family. It’s worth noting upfront that the value of a Roth IRA is unlocked only when you make money in the account. If you lose money over the long-term, you’d have been better off in a taxable brokerage account.

Downsides to the Roth IRA

A Roth IRA has a number of disadvantages:

Contributions are not tax deductible

Contribution and income limitations

No capital loss deductions

Complicated distribution rules

Early distribution taxation

10% Penalty taxation

Disadvantage #1: Contributions are not tax deductible

Roth IRA contributions are not tax deductible, so you won’t reduce your income taxes by funding one. Compared to a Traditional 401(k) contribution at an identical savings target, you’ll have less cashflow due to the income tax burden. The higher marginal tax bracket you’re in, the more taxes you’ll pay upfront by foregoing a Traditional 401(k) for a Roth IRA.

Disadvantage #2: Income Limitations

For 2022, you can only put $6,000 into a Roth IRA (or $7,000 if you’re at least age 50). In addition, Roth IRAs have maximum Modified Adjusted Gross Income (MAGI) limitations, which are discussed here. If you make more than the upper end of the Roth IRA MAGI limit, you can’t contribute to a Roth IRA.

There is a technique called a Backdoor Roth IRA that allows you to circumvent the MAGI limitations; however, it requires the care and skill of a professional to avoid violating the IRS’ Step Transaction Doctrine. The Step Transaction Doctrine basically says if you take a series of steps to get to the same result as you would have gotten with a single transaction, you’ve effectively made the single transaction.

Disadvantage #3: No Capital Loss Deductions

The IRS lets you annually deduct up to $3,000 of net capital losses against your other income for the year, where any excess beyond $3,000 can be carried forward to the next tax year. This deduction is an above-the-line deduction, making it even more valuable. But losses in a Roth IRA do not receive this tax treatment.

There is one exception to this rule. If you close all of your Roth IRAs, you can report any aggregate loss on the total basis as an itemized deduction on Schedule A. I’ve never heard of anyone ever doing this, but it does technically exist.

Disadvantage #4: Complicated Distribution Rules

Distributions from a Roth IRA are assumed to be taken in the following order:

Contributions first

Conversions second

Growth third

Having contributions come out first is actually an advantage to the account because it allows you to remove the principal without taxation; but if you’re going to make a distribution, it behooves you to have exact records of what dollars amounts in the account belong to what category. Otherwise, you’re likely to miscalculate your tax liability.

Disadvantage #5: Early Distribution Taxation

Tax-advantaged growth in a Roth IRA is very appealing, but the requirements for distributing that growth aren’t always straightforward. Generally speaking, there are two requirements and BOTH must be met to avoid ordinary income taxes on distributions from a Roth IRA:

Your earliest-existing Roth IRA is at least 5 years old

You are at least age 59.5, disabled, buying your first home ($10,000 limit), or inheriting the Roth IRA.

Disadvantage #6: 10% Penalty Taxation

Note that the above requirements don’t apply to the 10% additional penalty taxation, which is a second level of tax that can occur on a Roth IRA (yes, you can be taxed twice). You’ll incur a 10% additional withdrawal penalty unless you meet at least one of the exceptions. A few of the more common exceptions include:

At least age 59.5

Disabled

$10,000 for a first home

Death of the owner (inherited)

Education expenses

Medical premiums for unemployed

Medical expenses beyond 7.5% AGI

Substantially equal period payments

Example: Billy opened his first Roth IRA in 2020 with a $6,000 contribution, which is now worth $7,000 in 2021. He withdraws the full value of the account to pay for college. Because Billy didn’t have the Roth IRA for 5 years and education expenses aren’t one of the four ordinary income tax exceptions, Billy will pay ordinary income tax on the $1,000 of growth. But he won’t owe the 10% additional penalty tax on the $1,000 of growth because educational expenses are an exception.

How Much Money Do You Need to Hire a Financial Advisor?

This post discusses the minimum entry point to hiring a financial advisor. It’s much lower than you think!

There is a common misconception that you need to be wealthy to hire a financial advisor. While there are advisors who only work with high-net-worth clients, there are also advisors, such as Park 64 Capital, that open their doors to less wealthy clients. But what if you have minimal savings? This is common for young graduates as well as adults that haven’t put the pedal to the metal yet. These prospective clients find themselves in a tricky situation: they need professional advice to save that first $100,000 as quickly (and correctly!) as possible, but they need $100,000 to get advice in the first place. In these cases, the solution is to find a financial advisory firm that offers their services for a fixed monthly fee, meaning that you don’t need anything saved to get started.

Not all firms accommodate monthly billing for lower asset clients and every firm is going to have a preference depending on its ethos. Park 64 Capital, for example, has a good mix of wealthy and not-yet-wealthy clients. This goes hand-in-hand with our goal of making financial education and prosperity more broadly accessible.

Another worthwhile point to mention is that the minimum asset requirements financial advisors set falsely gives the impression to clients that value is only created when there are assets to invest. In reality, a good financial advisor helps clients with minimal assets by developing strategies to maximize their savings, minimize taxes, manage debts, and optimize insurance coverages. Financial advisors also serve as fantastic teachers and coaches for clients; it’s a huge advantage to have a knowledgeable touchpoint in your back pocket who knows the particulars of your situation and holds you accountable to the financial plan objectives.

Note: For the rest of the post, I’m going to focus on fee-only financial advisors, like Park 64 Capital, because these firms are held to a fiduciary standard, which means they put their clients’ needs before their own.

Asset Minimums and Monthly Billing

Financial advisory firms have minimum asset requirements to attract their desired clientele and ensure adequate payment for their services. Let’s look at some typical billing structures and how lower asset clients can easily be accommodated.

Most financial advisors charge a percentage of assets fee. For example, if a firm has a minimum $120,000 asset requirement and charges 1% per year, that equates to a $1,200 minimum annual fee. As your assets grow, so does the fee, which compensates the advisor for the complexity of growing and protecting bigger pools of your money.

If you’re just starting out, some advisory firms offer their services for a fixed annual fee, usually paid monthly, in lieu of having an asset requirement; this provides greater accessibility to financial advice. The monthly rate is usually equivalent to the minimum asset charge, but it can also be increased to account for complex client situations that require a larger time commitment from the advisor, such as for married couples or self-employed individuals.

Continuing our previous example, a financial advisor charging $100/month is equivalent to charging 1% of $120,000:

$100 per month = $1,200 per year

1% of $120,000 = $1,200 per year

When you’ve reached the minimum asset requirement, you’re moved over to the percentage of assets fee structure. In the example above, a $100 per month client would be moved to a 1% fee structure once their assets totaled $120,000.

How Lower Asset Clients Benefit From a Financial Advisor

When you fall into the lower asset category, you may be wondering what your monthly fee gets you. This is a common question, mostly because financial advising is commonly thought of as purely investment advice. While investments are definitely a big part of the overall service offering, the development of the comprehensive financial plan is the underpinning that keeps everything moving without interruptions.

For example, imagine you’re doing great in your career with a growing bucket of $50,000 saved. Then you get hit by an uninsured driver, indefinitely disabling you from your career. Your collision and uninsured motorist coverage wasn’t set up correctly, so you have to pay the enormous deductible for your hospital bill as well as the property damage to your car. Two years later, your employer’s disability insurance policy cuts you off based on a buried provision in the contract language. Now you’re hemorrhaging money to stay off the streets, and your loved ones are getting really tired of spotting you money.

The above example isn’t nearly as outlandish as you might initially think. Younger clients are generally at greater risk of financial ruin than older clients because they haven’t had time to save money yet. Thus, while the young may be in better health and are at a lower probability of having a risk-event, the devastation of that risk-event will be much worse. Not surprisingly, younger clients have a hard time imagining a worst-case scenario for themselves and often have little to no risk management measures in place as a result.

But it’s not all about reducing risks by making sure your insurances are set up correctly. Some of the other immediate advantages of working with a financial advisor, even if you don’t have a lot saved, include:

Building a complete strategy for financial success that considers all material details.

Creating mindfulness about your decisions and how they impact your financial goals.

Avoiding early mistakes that have lasting consequences (e.g. poor 401(k) allocations or suboptimal tax decisions).

Planning how much you need to save for emergencies, a first home, retirement, dependent education, etc.

Managing debt in the most efficient way possible.

Strategizing your investments. A good planner will help your portfolio blossom into a much larger one over time.

Teaching. An advisor is a fantastic resource for all financial questions, from beginner to advanced.

Coaching. You will be held accountable to your financial plan by a professional that cares about your success.

One of my favorite things about being a financial advisor is helping my clients discover just how much money (and risk!) they have been leaving on the table. It’s amazing to watch people’s eyes light up with motivation as they realize that becoming financially unassailable isn’t nearly as impossible as they once thought. If you’re reading the above eight item list and still feel like hiring a financial advisor isn’t worth it without having a large sum of money, I’d love the chance to blow away your expectations.

Why You Probably Need Private Disability Insurance

This post discusses how to think about private disability insurance, so you don’t accidently pass up on this important insurance coverage.

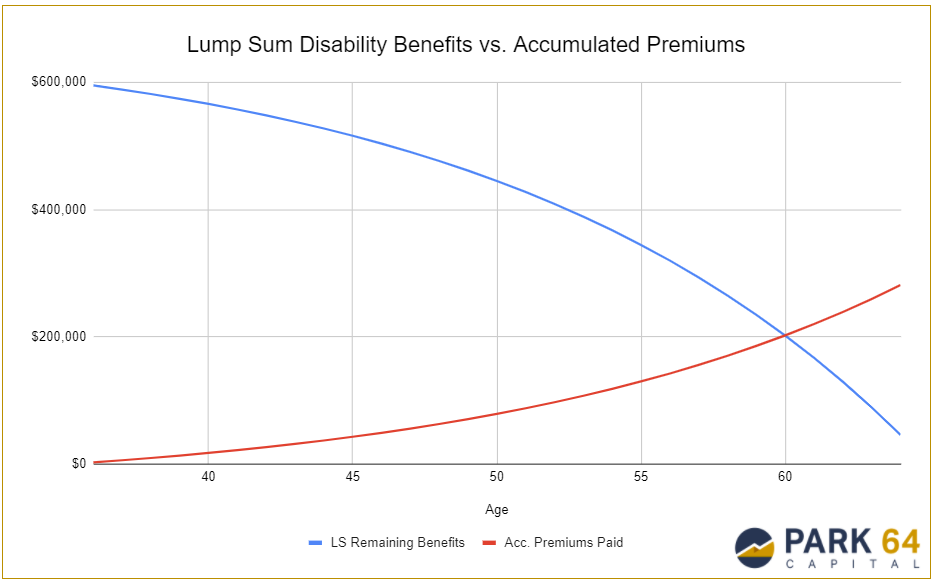

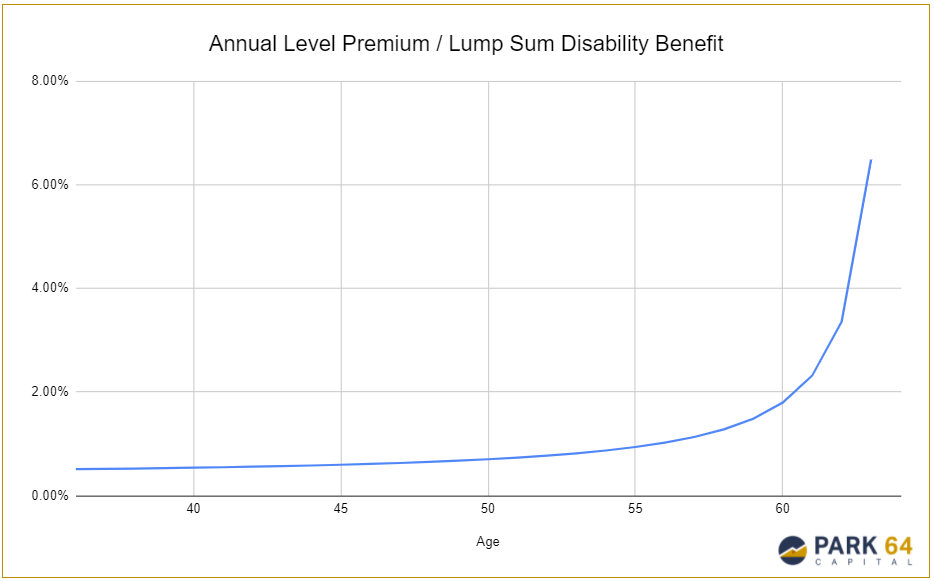

In my first 6 months as a full-time financial planner, I’ve learned that people don’t want to pay for private disability insurance. And who could blame them: the longer you own a disability insurance policy, the less benefits it pays. Compared to employer-provided group disability coverage, private disability insurance has significant premium costs. There is strong emotion tied to continuously sinking premiums into a policy that is designed to pay you less and less as you get older. In many ways, a disability insurance policy is like a depreciating lottery that you never want to win. But does that mean that purchasing private disability insurance is a bad deal? No. For most people, private disability insurance is the number one way to protect against lost income yet is often overshadowed by life insurance sales.

It’s hard for people to see the value of disability insurance because:

It’s a limited use indemnity product, meaning that it’s designed to pay you for a defined portion of lost wages and only while disabled.

It’s expected value is negative, and you only “win” if you go on claim. This is true for all insurance, but it still bears mentioning.

Compared to life insurance, where you’re either dead or you aren’t dead, the definition of disability can potentially be contested by the insurance company.

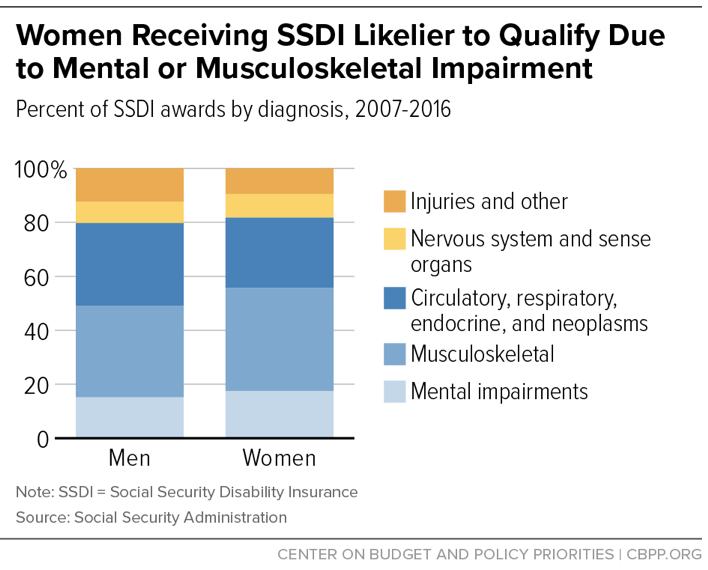

Regardless, most people probably need private disability insurance during their productive working years, typically from their early twenties to retirement. Let’s look at these quick facts before jumping into a deeper discussion about why disability insurance is so critical:

Arthritis & other musculoskeletal diseases, heart disease, cancer, mental health disorders, diabetes and nervous system disorders are the leading causes of disability in the U.S.

Disability, on average, is almost 3 times as likely as death during your productive working years.

Disability insurance is more valuable when you’re young and becomes less valuable as you age.

Employer-provided group disability insurance policies aren’t portable and typically only cover your career occupation for two years of disability, among other shortcomings beyond the scope of this post. You should be very cautious about trusting your employer’s group policy to protect your income to retirement unless you and your advisor already understand all the fine print.

How Private Disability Insurance Works

Private disability Insurance charges you a level monthly or annual premium and will pay you a tax-free monthly benefit for a predetermined time, typically until age 65, if you become disabled and unable to work. Benefits are typically 60-70% of your current income. Depending on how the disability insurance policy is structured, you may be eligible for partial or residual disability benefits if you can return to work but only in a limited capacity. If you don’t become disabled during the policy’s lifetime, you don’t get your money back.